Health spending accounts are used to pay for medical expenses that your healthcare plan doesn’t cover, such as deductibles or copays. They’re part of what’s called consumer-directed health care. Consumer-directed means you manage more of the money you spend on health care costs.

There are several types of health spending accounts, including:

- A health savings account (HSA) is a tax-favorable savings account for medical expenses and is typically used in conjunction with a high-deductible health insurance plan. Unlike a flexible spending account (FSA), unused money in your HSA isn’t forfeited at the end of the year; it can be rolled over and used for the following year’s qualified health expenses. You can only have an HSA if you enroll in an HSA-compatible health plan.

- A flexible spending account (FSA) is set up by your employer. They own the account, but you get to decide which qualified medical expenses to pay for with your FSA. What makes it flexible? It works with most of PPO employer-sponsored health plans. Unused money in the FSA at the end of the year may have to be forfeited. In addition to medical expenses, FSAs can often be used to pay for childcare expenses, as well as other expenses.

- A health reimbursement arrangement (HRA) is a benefit fund set up by your employer. Your employer contributes a certain amount of money each year for you to use for medical expenses not covered by your health plan. Only your employer can fund an HRA. In most cases, if all of the money is not used by the end of the year, the HRA can be rolled over to the following year – as long as the employee stays on the same plan.

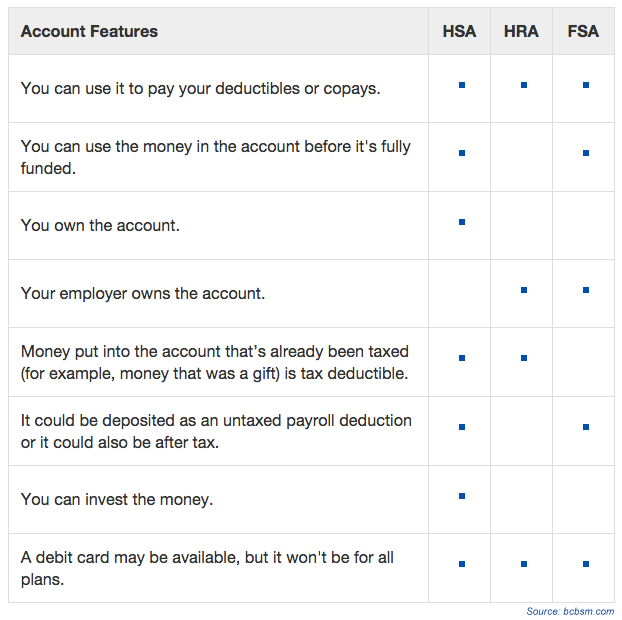

Money is deposited in these accounts tax-free and is taken out tax-free or tax-deductible. You can use it to pay for qualified medical expenses. A debit card may also be available depending on your plan. Where they differ is the kind of health plan they work with, who owns the account, who controls it, and who can put money into it. Here is a comparison chart showing some of the similarities and differences:

Examples of Qualified Medical Expenses

If you have one of these health savings accounts, it’s important to be aware of what is considered a qualified medical expense to be able to use these funds. A qualified medical expense is one that can be purchased with tax-free money through your health savings account.

Some examples of qualified expenses include:

- insulin and diabetic supplies

- eye surgery (including laser eye surgery)

- doctor’s fees

- fertility enhancement (including in-vitro fertilization)

- first aid supplies and bandages

- dental treatment (x-rays, fillings, extractions, dentures, braces, etc.)

- braces and supports

- wheelchairs and walkers

- contact lenses and reading glasses

- prescribed medications

- sleep aids

Note that some qualified medical expenses require a prescription from your doctor. If you’re thinking about purchasing something with your health savings account, it’s recommended that you first check to ensure that the expense is qualified and what the procedure is for getting it covered (such as sending a copy of your prescription/receipt or filing a reimbursement request form).

Still Have Questions About Health Spending Accounts?

If you have any questions regarding health spending accounts or open enrollment, contact The Missouri Bar Insurance Marketplace. Our benefits counselors are ready to help you find the right health insurance policy now.