Health Insurance for Members of The Missouri Bar

The Missouri Bar Insurance Marketplace is available to Missouri Bar members, their spouses and dependents, and their employees.

We offer a wide-range of health options from leading providers for you and your family. Everyone is different, and we know that it is important for you to have a variety of health plans to choose from so you can find what works for your lifestyle and financial picture.

Individual & Family Health Insurance

Also known as “Obamacare plans”, this type of major medical insurance meets the ACA’s minimum essential coverage requirements. These plans are eligible for lower premiums through government subsidies — see if you qualify. [NEW: 2026 ACA Open Enrollment Guide]

BarHealthTM for Solo Practitioners

Option 1: This option provides independent professionals, small business employees, or anyone seeking reliable coverage with access to benefits traditionally reserved for employees of large organizations. These plans includes access to the CIGNA PPO network. Benefits begin on the 1st of the month after 30 days from enrollment. (For example, if you sign up in January, your coverage starts March 1st.)

Option 2: This option includes plans designed for solo-practicing “business of one” attorneys and their dependents, harnessing the size and scale of membership to bring you savings. These plans utilize the PHCS network.

Non-ACA Health Insurance*

Also known as “short-term health insurance”, non-ACA plans can be an affordable alternative for those who are in good health and don’t need coverage for maternity, mental health, substance abuse, or preexisting conditions. There is no designated enrollment period for these plans; you can apply at any time.

HAVE QUESTIONS?

Speak with a licensed benefits counselor.

Why shop for individual health insurance on The Missouri Bar Insurance Marketplace?

One Stop Shopping.

No need to jump to multiple websites to compare

plans. Members now have  an easy way to evaluate every available plan from leading companies like Humana, UnitedHealthCare, Coventry and Blue Cross & Blue Shield. On renewal, you’ll have the ability shop and compare your plan with the most up to date health plan options to ensure that you always have the most competitive coverage.

an easy way to evaluate every available plan from leading companies like Humana, UnitedHealthCare, Coventry and Blue Cross & Blue Shield. On renewal, you’ll have the ability shop and compare your plan with the most up to date health plan options to ensure that you always have the most competitive coverage.

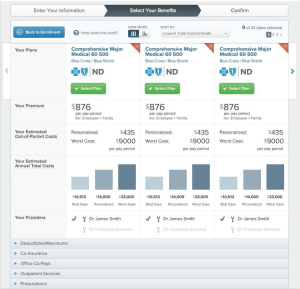

'Best Fit' Recommendation Engine Helps You Save Money.

Is it possible to have more options and keep

the decision process easy? Absolutely, this is where our private exchange thrives with the “Best Fit” tool. “Best Fit” is much more than an interactive decision support tool. It’s a whole new approach to insurance shopping, helping you make a more informed and personalized decision across a range of plans – all through an engaging experience. “Best Fit” guides you through the buying process by asking a few simple questions and then suggesting the plan that best fits your individual needs. Matching your requirements with the most suitable deductible, coinsurance, copays, prescription drug coverage, and provider network can dramatically reduce your total out of pocket costs and save you money.

Absolutely, this is where our private exchange thrives with the “Best Fit” tool. “Best Fit” is much more than an interactive decision support tool. It’s a whole new approach to insurance shopping, helping you make a more informed and personalized decision across a range of plans – all through an engaging experience. “Best Fit” guides you through the buying process by asking a few simple questions and then suggesting the plan that best fits your individual needs. Matching your requirements with the most suitable deductible, coinsurance, copays, prescription drug coverage, and provider network can dramatically reduce your total out of pocket costs and save you money.

Personalized Customer Support from Licensed Benefits Counselors.

We know time is money, especially with attorneys. From basic questions to in-depth consultations, it’s important to have a live person awaiting your call when you need help. It’s also important to work with an advisor that takes the time to develop specific knowledge about you and your family. Our dedicated team of Benefits Counselors are specially trained to work with attorneys and can provide you with expert advice about each health plan. They have already helped thousands of members with common inquiries like checking provider networks, making sure prescription drugs are covered, and explaining difficult to understand insurance jargon.

Concierge Level Advocacy Throughout the Year.

If you’ve ever had an issue with your coverage and had to deal directly with your insurance carrier, you know how valuable it is to have an  advocate on your side. Billing errors, lost ID cards, problems with claims, and changes in your family status are all common occurrences that require time and effort. Instead of spending your valuable time waiting on hold, let us do the heavy lifting. Our Service Team has “premier” level access to insurance company service departments. Sometimes you just have to get through to the right people to get your issues resolved and we are experts in that area.

advocate on your side. Billing errors, lost ID cards, problems with claims, and changes in your family status are all common occurrences that require time and effort. Instead of spending your valuable time waiting on hold, let us do the heavy lifting. Our Service Team has “premier” level access to insurance company service departments. Sometimes you just have to get through to the right people to get your issues resolved and we are experts in that area.

Best Prices Available for Missouri Health Plans.

The leading health insurance providers in the state of Missouri all participate on the exchange. All health insurance plans and rates are regulated by the Missouri Department of Insurance. You will not find better pricing with any of these providers, even if you purchase directly from the carrier. The private exchange can also help you determine if you’re eligible for a government subsidy and assist you when applying.

Specially Priced Supplemental Benefits.

You also have access to special member group pricing on useful benefits such as dental, vision, long term disability, ID theft, telemedicine, pet insurance, and more. Plans are offered by some of the best and well known providers in the U.S. like MetLife, Guardian, and Allstate.

Shop Health Plan Options From:

* Non-ACA/short-term health insurance is medically underwritten and does not cover preexisting conditions. The coverage does not meet ACA minimum essential requirements. Availability varies by state.